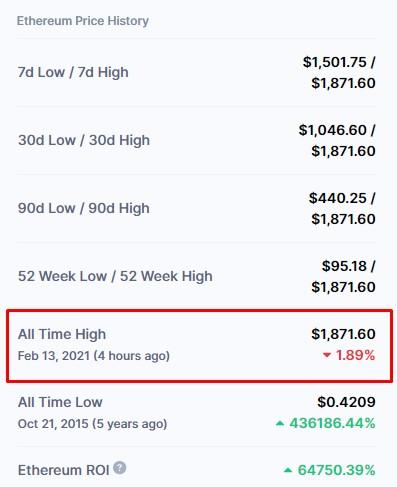

由于美国证券交易委员会 (SEC) 批准了一组即时以太交易基金 (ETF) 之后,以太坊出现了显著增长.本周,以太坊达到每枚硬币的最高值3980美元,大约低于历史最高值的18.4%.

以太子期货市场达到创纪录水平

In the midst of the dynamic activity on ethereum spot markets, ether derivatives have also seen substantial demand. Ether futures open interest has reached 史无前例的水平. Concurrently, the aggregated open interest (OI) in 乙烯 (ETH) options has been hovering near all-time high levels. As of May 28, 2024, the total open interest in ethereum futures stands at about .05 billion.

(图片来源网络,侵删) 根据coinglass.com的数据,以太坊开放利息.

(图片来源网络,侵删) 根据coinglass.com的数据,以太坊开放利息.

High open interest in ethereum futures and options contracts generally indicates increased trading activity and interest from both institutional and retail investors. This heightened 乙烯 open interest can lead to greater price volatility as traders actively manage their positions, potentially signaling an upcoming significant price movement. Currently, the aggregated open interest in ether options contracts is .99 billion.

Regarding futures, out of the .05 billion in OI, 币安 leads with .14 billion. Bybit follows with .48 billion, and Okx holds .18 billion. In the options market, Deribit dominates with .77 billion of the .99 billion aggregate. Following Deribit are Okx, Binance, and Delta Exchange, respectively.

(图片来源网络,侵删)

(图片来源网络,侵删)

On spot markets, 鱼 has risen 33.3% over the past two weeks, while 30-day statistics show a 16.9% gain. Although 鱼 recently came closer to its all-time high, it is now 20.9% below the peak of ,878 per unit set on Nov. 10, 2021. The increase in ethereum’s value, following the 批发现场乙烯ETF, has not only impacted spot markets but has also significantly boosted the derivatives segment.

您对以太坊衍生品市场的行动有什么看法?